SIP, SWP & STP in Mutual Funds

Investing systematically is a prudent way to manage finances and build wealth over time.

In the realm of mutual funds, three popular systematic plans are SIP (Systematic Investment Plan), SWP (Systematic Withdrawal Plan), and STP (Systematic Transfer Plan).

Each serves distinct purposes and caters to different financial needs.

Here’s a detailed look at each plan 👇

1) 🌴Systematic Investment Plan (SIP):

📌Definition:

👉A disciplined approach to investing a fixed amount in a mutual fund at regular intervals (e.g., monthly).

📌How It Works:

👉Regular investments regardless of market conditions.

👉Purchases more units when the market is low and fewer units when the market is high, averaging the cost over time.

👉Encourages disciplined investing and benefits from compounding.

📌Example:

Invest Rs. 5,000 every month:

- NAV is Rs. 20:

Units bought =5,000/20=250

- NAV is Rs. 16:

Units bought =5,000/16=312.50

In this way, units are accumulated by periodically running the NAV of the Fund.

📌Benefits:

👉Easy to invest and monitor.

👉Suitable for long-term goals.

👉Compounding enhances growth.

2) 🌴Systematic Withdrawal Plan (SWP):

📌Definition:

👉Allows you to withdraw a fixed amount from your mutual fund at regular intervals.

📌How It Works:

👉Invest a large corpus initially.

👉Withdraw a fixed amount periodically (e.g., monthly) to generate regular income.

📌Example:

👉Invest Rs. 10 lakhs in a debt mutual fund, and withdraw Rs. 10,000 monthly.

📌Benefits:

👉Provides steady income.

👉Suitable for retirees or those needing regular cash flow.

👉Flexible withdrawal options.

3) 🌴Systematic Transfer Plan (STP):

📌Definition:

👉Transfers investments from one mutual fund scheme to another within the same fund house.

📌How It Works:

👉Invest a lump sum in a liquid fund.

👉Transfer a fixed amount regularly to an equity fund to mitigate risk.

📌Example:

👉Invest Rs. 5 lakhs in a liquid fund, transfer Rs. 50,000 monthly to an equity fund.

📌Benefits:

👉Gradual investment in equity reduces risk.

👉Earn potential returns on both source and target funds.

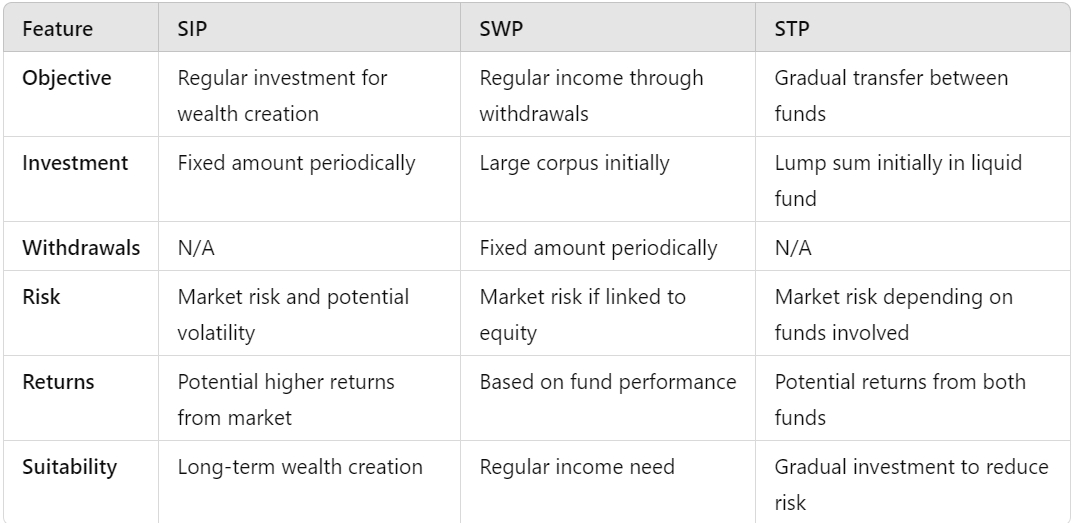

🌴Comparison Summary:

Thank you,

By - Kapil Goenka

(Founder - Eternity Financial Services)

MF Distributor

(AMFI Reg. ARN: 90153)

Comments

Post a Comment